Alternative Data

Interview with Thinknum Co-Founder Justin Zhen, remote jobs, the war against the NYT and more

My name is David and I’m a partner at Open Water Accelerator. This week’s newsletter features an exclusive interview with Justin Zhen, Co-Founder of Thinknum Alternative Data ($12.6M raised), where he talks about Adam Neumann evicting him from his WeWork space over a blog post and building Thinknum.

As always, we included some weekly tech news and job opportunities in tech and finance.

founder interview: building Thinknum🔨

This week we sat down with Thinknum Co-Founder Justin Zhen. This interview has been edited for length and clarity.

What is Thinknum?

Thinknum has been around for six years now. Our product has been live for four years. We organize and retrieve public data from the web. We track data points such as store locations, product pricing, or job listings. We then sell this data to over 270 corporations who want to understand the market better or invest more intelligently. We've raised $12.6 million in total, and we currently have a team of 33 people.

What do you know now that you wish you knew when you started your company?

I mean I didn't know anything when I started the company. (Laughs) I think the main lesson indirectly is you need to spend money to make money. I personally come from a really humble background. We didn't eat out at a restaurant for over 10 years, just because you know, we couldn't afford it.

So when starting a company, when you're figuring out how to acquire customers anything that costs more than say a few hundred dollars, to me personally, it just seemed like a lot of money. And at first, I was very hesitant to experiment with user acquisition tactics.

It took me a while to learn. We're trying to sell a product to a very high-end audience such as investment firms and directors of large companies. You need to meet these people in person, sponsor conferences, and hire people to do content. So you really have to spend money to make money. And after I internally accepted that, we really started taking off from there.

How did you get your first 100 customers?

When we were trying to get our first 100 customers, we didn't have much money. What we did have was a product that was pretty unique. We were fortunate to have gone through a school where a lot of the alumni happened to work in our target market.

Our target market was professional investors like hedge funds, private equity funds, and traditionally Princeton University, that's where we went, they sent half the graduating class to that sector.

We did a lot of cold outreach. We said, “We're a couple of guys from Princeton, we built this product, which we think is unique and can benefit your process. Can we please take five minutes and show it to you?”

And so they took it. When we were showing them the product our first couple calls in, something went wrong. So we would do a call and then we would fix the bugs overnight. Then the next day, we would hop on the phone and do it all over again.

What is the biggest risk you have ever taken?

This is a little more fun and one of the more popular stories about us. So about four years ago when we first started the company, we were working out of a WeWork. Our team collected data on the public web that contained information on when customers joined WeWork and when they left. It was a pretty rich data set.

So we looked at the data and saw what we could learn. We found that the churn rate had been increasing over the past few months. We also found that they built this social network that almost none of their users used. They were raising capital with a technology company valuation and the social network was the pitch. So we blogged about it and then Reuters wrote about our blog post.

The next day Adam Neumann, who was the CEO at the time, personally evicted us and gave us 30 minutes to leave our office.

Obviously, WeWork kept raising more money at higher valuations over the next couple of years until recently, when our blog post was proven right. Our data found the flaws in their business model.

Now we're getting asked to speak in documentaries and movies about WeWork and we are glad to be vindicated. But it is still the biggest risk we ever took because we had to physically leave our office to do so.

What has been your biggest mistake?

I definitely made a lot of mistakes. In general, I think one mistake that we made is not letting go of someone fast enough. I think when you're a founder and you spend so much time with your team, you start to see each other as friends.

If someone is not working out or is not the right fit, in your heart you know that that it is not a fit, it could still be difficult to actually pull the trigger. In general, the biggest mistake I think would be letting someone who you know is not the right fit stick around for too long. And honestly, it's not good for them either.

Who did you look up to while growing up and who inspires you today?

This is easy. While growing up, there was Michael Bloomberg. I grew up in New York, and he's the most successful entrepreneur out of New York. He also happened to do it in in our industry, selling data to investment firms. Today, obviously, I still look up to Michael Bloomberg.

I also look up to a lot of serial entrepreneurs. Building one successful company is extremely hard, building multiple is even harder. The press loves Elon Musk and gives him credit for all the incredible things he does, but another founder that sometimes slides under the radar a little bit is Jack Dorsey. He built two $10 billion companies and he did it very quickly. Obviously, building a company is extremely hard. Doing it twice? That's who I really look up to.

What do you think the future of software is?

I'm going to comment on what I know best, which is the future of data. I think there is going to be a lot of consolidation in the big data analytic space. There's a lot of tools out there and every tool does something well. Ultimately, I think the end users will want to see all of this data and analytics in fewer platforms. I’ve gotten this feedback from other funds we work with.

I also think there is going to be a lot more data. Internet of Things will finally start to move over the next few years. We have been talking about this for along time now but I think it will finally happen.

Finally, and this is very specific to us, there's more companies that are going online (pharmaceuticals, trucking, etc). When that happens it provides more data to the index and gives us better indicators for those sectors of the economy.

news 📣: twitter fight edition 🥩

The Players:

Dr. Balaji S. Srinivasan: Former CTO of Coinbase and former General Partner at Andreessen Horowitz

Taylor Lorenz: New York Times Style Reporter

Background:

Last week the New York Times was writing a story on psychiatrist and blogger Scott Alexander and refused to conceal his identity. Revealing Scott’s full name would interfere with his treatment of mentally ill patients. In response, Scott deleted his blog and Silicon Valley called for a boycott of the NYT.

The Fight:

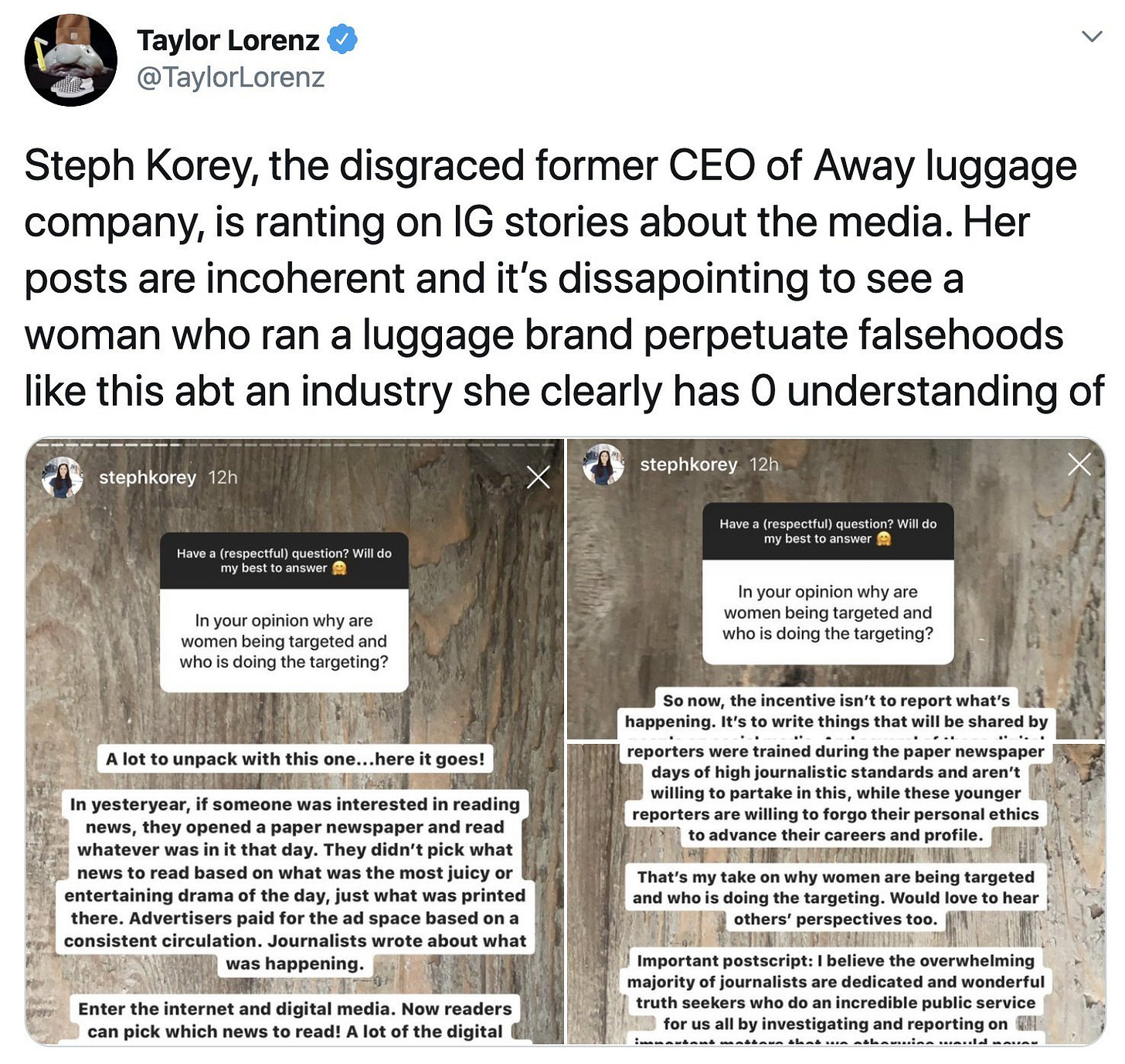

Earlier this week Taylor Lorenz, a NYT style reporter, tweeted this.

Dr. Srinivasan felt that the tweet targeted female founders so he spoke out. A Twitter War ensued with participation from many influential VCs.

The war culminated with Srinivasan calling Taylor racist, a meme bounty for memes against Lorenz, and a potentially illegal leak of a Clubhouse conversation where members expressed their displeasure with the press.

Lorenz’s Side of the Story (Twitter Thread) and Srinivasan's Side of the Story (Twitter Thread)

tech and finance opportunities

Exclusive opportunities curated for Open Water Weekly Subscribers. Subscribe today to receive founder interviews and job opportunities delivered directly to your inbox.

next week…

Next week’s letter will feature an interview with Chris Bakke, founder of Interviewed (acquired by Indeed) and some more remote job opportunities.